What Does Parwaaz Card Loan Cover? Full Expense Breakdown: The Punjab Government’s Parwaaz Card Scheme has been praised by many people looking for work abroad, especially young people who have been offered jobs abroad but don’t have the money to finish the necessary paperwork.

One of the things that people ask most often is

What kinds of costs does the Parwaaz Card loan actually cover?

This detailed guide explains what costs are covered and what costs are not covered, as well as the loan’s usage limits, verification processes, and key conditions. This way, applicants can easily understand how the interest-free loan can be used.

Understanding the Purpose of the Parwaaz Card Loan:

You can’t use the Parwaaz Card to get a loan for anything. It is a purpose-specific, interest-free financial aid program made just for people who already have a job offer from another country.

Core Objectives of the Scheme:

- Make legal working abroad easier

- Lessen your reliance on brokers and agents

- Stop workers from being exploited

- Help kids from low- and middle-income families.

The loan can only be used for things connected to the job because it is backed by public funds.

Key Principle: Purpose-Specific Loan:

Unlike regular bank loans, the Parwaaz Card loan can only be used for costs directly tied to working abroad.

- Costs related to the job are paid.

- It doesn’t cover personal or living costs.

This makes sure that government funds are used honestly and wisely.

Who is eligible for Parwaaz Card Loan coverage?

Applicants with verified overseas job offers meeting government eligibility criteria can receive Parwaaz Card Loan coverage. All expenses are approved after strict verification to ensure funds support legitimate foreign employment opportunities.

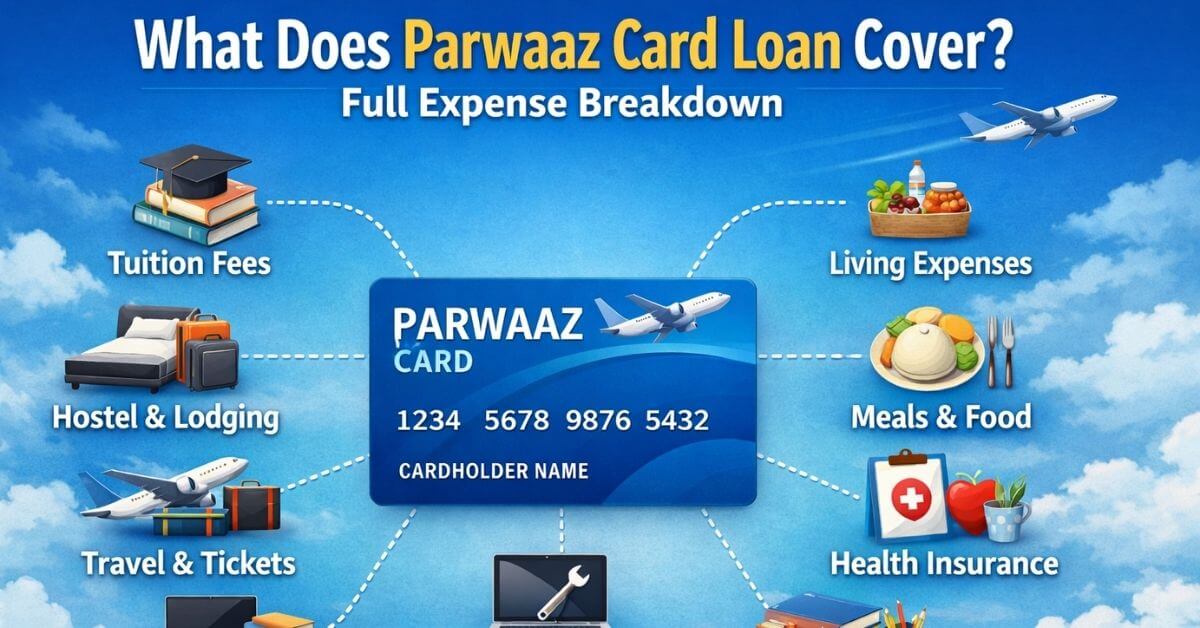

Major Expenses Covered Under the Parwaaz Card Loan:

Here is a full list of all the types of expenses that can be paid for with a Parwaaz Card.

1. Visa Application and Processing Fees:

Visa fees are one of the biggest problems for people who want to work abroad.

Costs related to visas that are covered are:

- Fees for applying for a work visa

- Fees for an embassy or consulate

- Visa fees and costs to process visas

- Costs of required visa paperwork

The exact amount is based on the country of location and type of visa, but the costs of a standard work visa are covered.

2. Mandatory Medical Examination Costs:

Most countries want people who work abroad to pass certain physical tests.

Medical bills paid for:

- Medical exams at places that are approved

- Must have medical exams, X-rays, and blood tests

- Medical fitness certificates needed to process visas

Personal medical care that isn’t tied to work isn’t covered.

3. Air Ticket (Flight) Expenses:

Most of the time, international travel costs the most.

Costs of flights covered:

- International economy-class ticket for one way

- The price of the ticket includes airport taxes.

There are no fees for luxury travel, ticket changes, or extra luggage.

4. Documentation and Legal Processing Charges:

A lot of jobs abroad need verified documents.

The following reporting costs are covered:

- Authentication of school or skill badges

- Legal documents that employers need

- Fees for government verification

- Documentation fees related to contracts

These fees are necessary for immigration and for employers to follow the rules.

5. Employment-Related Processing Costs:

For some job offers, there are extra handling needs.

Could have:

- Costs for verifying employment

- Processing fees for the government

- Costs of job-specific compliance

These costs are okay as long as they are checked out case by case.

Check Also: When Does Parwaaz Card Loan Repayment Start? – Complete Guide

Expenses NOT Covered Under the Parwaaz Card Loan:

So there is no misunderstanding; people who want the loan must know exactly what it does not cover.

Expenses that are not paid include:

- Costs for yourself or your family

- Places to stay abroad

- The cost of food and transportation every day

- For business or trading reasons

- Shopping, cell phones, or electronics

- Fees for an agent or middleman

Misusing money could lead to legal action or being kicked out of the program.

Does Parwaaz Card Loan include air ticket cost?

Yes, the Parwaaz Card Loan covers one-way economy class air ticket expenses required for overseas employment after job verification. Luxury travel upgrades and excess baggage or personal travel costs are not included under the scheme, ensuring proper use of funds.

How Are Covered Expenses Verified?

After a thorough check by the Punjab Skills Development Fund (PSDF), all costs are cleared.

Parts of verification are:

- How real the job offer is

- Verification of the employer

- Cost assessment for each destination

- How reasonable the claimed costs are

Only prices that are necessary and make sense are okay.

Is Cash Given Directly to Applicants?

Most of the time:

- Funds are only given out for approved uses.

- Payments can be set up to make sure they are used for the right purpose.

- Applicants are told how the money will be distributed.

This method stops abuse and makes sure that people are responsible.

Official Organization Website (Preferred Format): https://www.psdf.org.pk/

Are medical tests covered under Parwaaz Card Loan?

Mandatory medical examinations required for overseas employment are covered under Parwaaz Card Loan. This includes approved medical center tests fitness certificates and required health screenings linked directly to visa and job requirements.

Can Applicants Decide How to Spend the Loan?

Not at all. The Parwaaz Card loan can’t be used for anything.

To Applicants:

- Can’t use the money for personal things

- Can’t go over the allowed amounts

- Must stick to the accepted structure for expenses

Any violation could lead to healing or being unable to play in the future.

What If Costs Increase After Approval?

If prices go up for things like airfare:

- Applicants must follow the approved rules.

- There is no promise of more money.

- It is very important to get an accurate cost estimate during the application process.

Why Are Some Expenses Excluded?

Personal costs don’t include:

- Stop people from misusing state money

- Make sure there is justice and honesty.

- Let more candidates who deserve it get the reward.

- Make sure the plan can be paid for.

Parwaaz Card vs Private Agent Financing:

| Expense Type | Parwaaz Card | Private Agents |

|---|---|---|

| Visa fees | Covered | Often inflated |

| Medical tests | Covered | Frequently overcharged |

| Air ticket | Covered | High markup |

| Interest | Zero | Very high |

| Transparency | High | Low |

This comparison shows why the Parwaaz Card Scheme is a safer option.

Common Misunderstandings About Covered Expenses:

Myth 1: The loan can be used for living expenses

False. Only job-related costs are allowed.

Myth 2: Agent fees are included

False. Agent involvement is not permitted.

Myth 3: Luxury travel is covered

False. Only standard economy travel is approved.

Why Clear Expense Coverage Matters

Making rules clear helps applicants:

- Plan your money well.

- Stay away from application rejection

- Avoid delays

- Be careful with your money.

Advice for Applicants:

Applicants should:

- Submit realistic and accurate expense details

- Keep all documents ready

- Avoid agents promising extra benefits

- Follow only official instructions

Incorrect information can delay or reject applications.

Economic and Social Impact of the Scheme

By covering essential costs, the Parwaaz Card Scheme:

- Enables overseas employment

- Increases foreign remittances

- Improves household incomes

- Reduces unemployment pressure

This contributes to long-term economic stability.

Final Answer: What Expenses Are Covered?

The Parwaaz Card loan covers only essential overseas employment expenses, including:

- Fees for processing visas

- Medical exams that are required

- International plane ticket for one way

- What paperwork is needed and attorney fees

It does not cover personal, living, or agent-related expenses. https://www.psdf.org.pk/parwaaz-card/

Conclusion:

The Parwaaz Card Scheme covers the most important costs of starting a career abroad in a clear, interest-free, and purpose-specific way for people looking for work abroad.

Applicants with confirmed job offers should only apply through official methods and carefully follow the instructions to make sure they are approved and can work abroad.