Financial aid programs are still an important part of Pakistan’s economic plan in 2026. The government has expanded its aid and funding programs because of rising costs of living, unemployment, and the needs of small businesses. Among these, the Parwaz Card has become a new type of support that focuses on helping people make a living.

However, a lot of people still mix up the Parwaz Card with regular government loan programs. Some people think that both programs are the same, while others think that the Parwaz Card is just another business loan.

In fact, these programs are meant to help very different groups of people and achieve very different goals. This guide tells you the main differences between the Parwaz Card and government loan programs in 2026 so that you can pick the best one for your budget.

Parwaz Card Compared to Govt Loan Schemes 2026:

Purpose of Parwaz Card vs Loan Schemes

The main difference is what each tool is trying to do.

Parwaz Card Objective:

The Parwaz Card is meant to give people who are having trouble with money a financial break. Its main goal is to help people make a living, not to provide formal business funding.

- Parwaz Card assistance can be used for:

- Small tasks that bring in money

- Stable household finances:

- Help with skill growth

- Needs for a small business startup

- Help with money emergencies

The goal is to help people make sure they have a steady income and improve their quality of life without pushing them to start businesses.

Traditional Government Loan Schemes Objective:

Loan programs from the government are mostly geared toward businesses and industries. They want to spread:

- Business ownership

- Growth of SMEs

- Young businesses

- Modernization of agriculture

- Investment in industry

When funds are given out, clear business terms and growth goals are included.

To sum up, the Parwaz Card helps people make a living and get access to banking services, while loan programs promote economic growth and business growth.

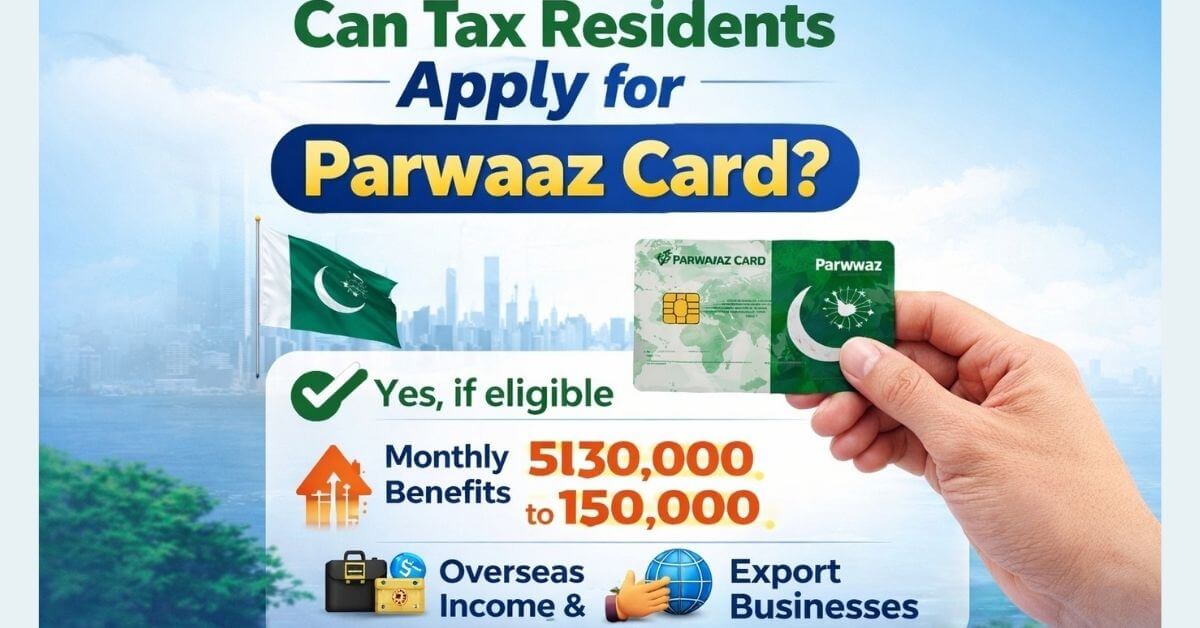

Eligibility Requirements Comparison:

Eligibility criteria often determine which program people can access.

Who Can Apply for a Parwaz Card?

The Parwaz Card is mostly aimed at regular people, such as:

- Families with low income

- Youth without jobs

- Off-site workers

- People with small incomes

- People who don’t have businesses listed

It’s easier to keep the program open by making the documentation standards simpler.

Who Can Apply for Government Loan Schemes?

Most types of loans need:

- A plan for a business

- Proof that a business was active

- Income records

- History of banking

- Surety bonds or property

- Based on sector, eligibility

Some programs only help farms, exporters, or registered business owners, which makes it harder for people with low incomes to use them.

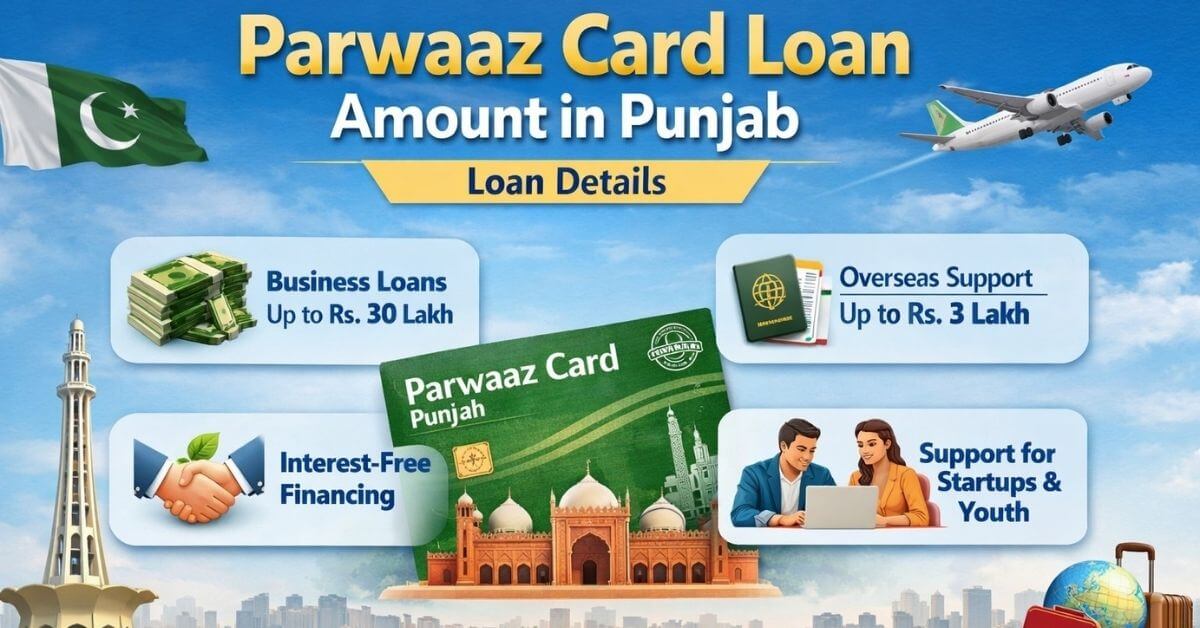

Loan Amount and Financial Limits:

Parwaz Card Funding Size

The Parwaz Card gives small amounts of money to help people improve their way of life instead of making big purchases. Most of the time, money is used for

- Setting up a small business

- The tools and gear

- Activities that pay based on skills

- Help with family finances

The amounts are smaller, but they are easy to get.

Government Loan Scheme Funding

Loan programs offer bigger amounts of money, usually between a few hundred thousand and several million rupees. These loans help with:

- Purchases of machinery

- Setting up the factory

- Equipment for farming

- Growth of the business

- Getting trade done

When amounts go up, standards also go up.

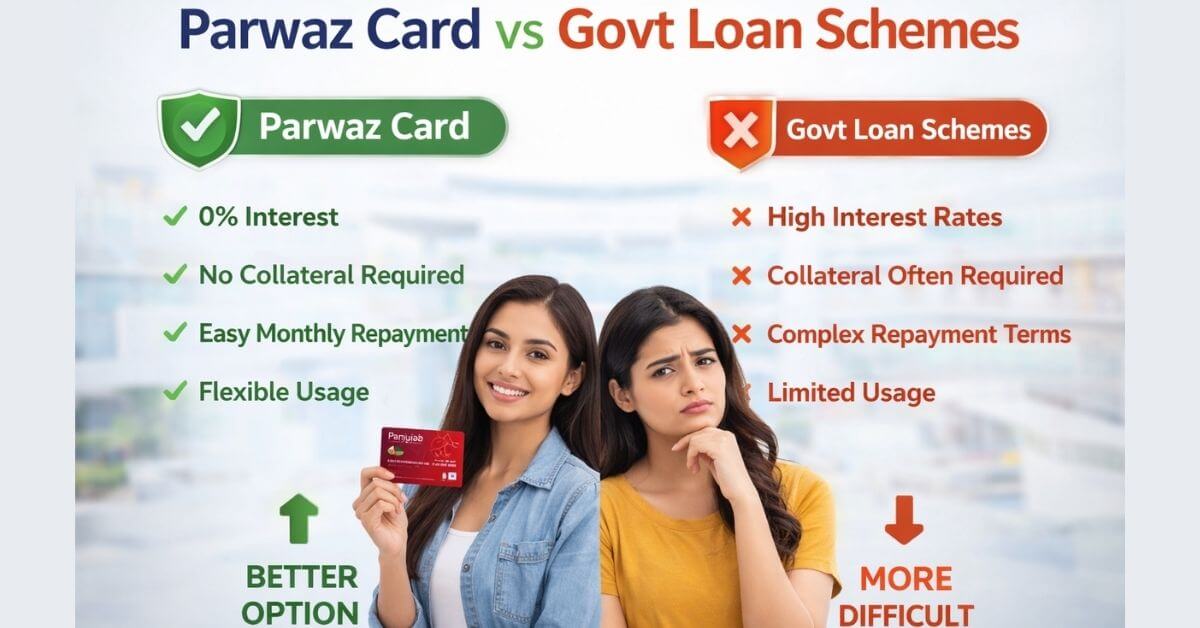

Benefits of Parwaz Card Compared to Govt Loan Schemes 2026:

- Easier Eligibility for Regular Citizens: The Parwaz Card gets rid of complicated banking barriers by welcoming low-income families, unemployed youth, and informal workers. It also makes financial help available without needing business registration, guarantors, or detailed income histories like other government loan programs do.

- Faster Approval with Less Documentation: Unlike lengthy loan applications involving banks and collateral checks, the Parwaz Card process is streamlined and done in an office setting with only basic identity verification. This means that eligible applicants can get decisions much more quickly when they need money quickly.

- Lower Financial Risk and Less Pressure to Repay: The Parwaz Card offers smaller, more focused aid on livelihoods with flexible payback plans. This helps recipients avoid the heavy debt, high interest rates, and strict recovery actions that are common with traditional government loan programs.

- Flexible Use of Funds for Daily Living and Income Support: Government loans can only be used for approved business purposes. The Parwaz Card, on the other hand, lets recipients use funds for household needs, skill development, starting a micro-business, and activities that bring in small amounts of money without being constantly watched.

- Support for Informal and Rural Communities: The Parwaz Card actively reaches daily wage earners and rural households that often have trouble getting bank-based funding. This makes sure that everyone in Pakistan has a chance to benefit, rather than just people in cities.

- Great for Stability in the Short Term Complex Business Growth: The Parwaz Card is meant to help citizens with immediate financial problems and to stabilize their income. While government loan programs are better for entrepreneurs who want to grow their businesses on a large scale, the Parwaz Card is better for families who are facing short-term economic pressure.

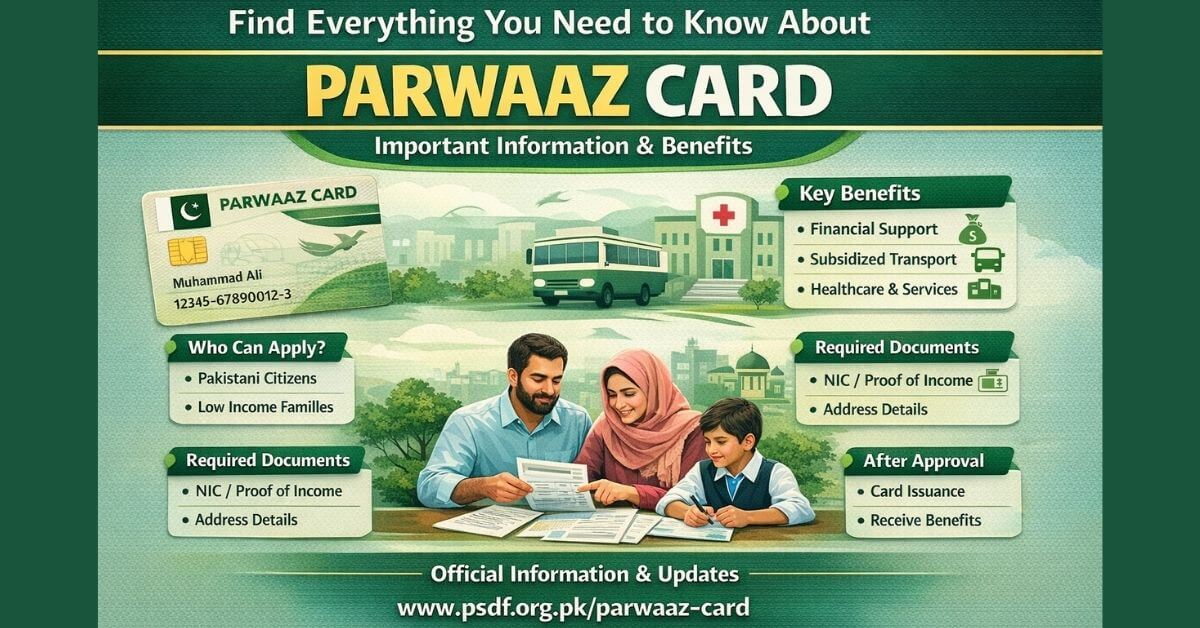

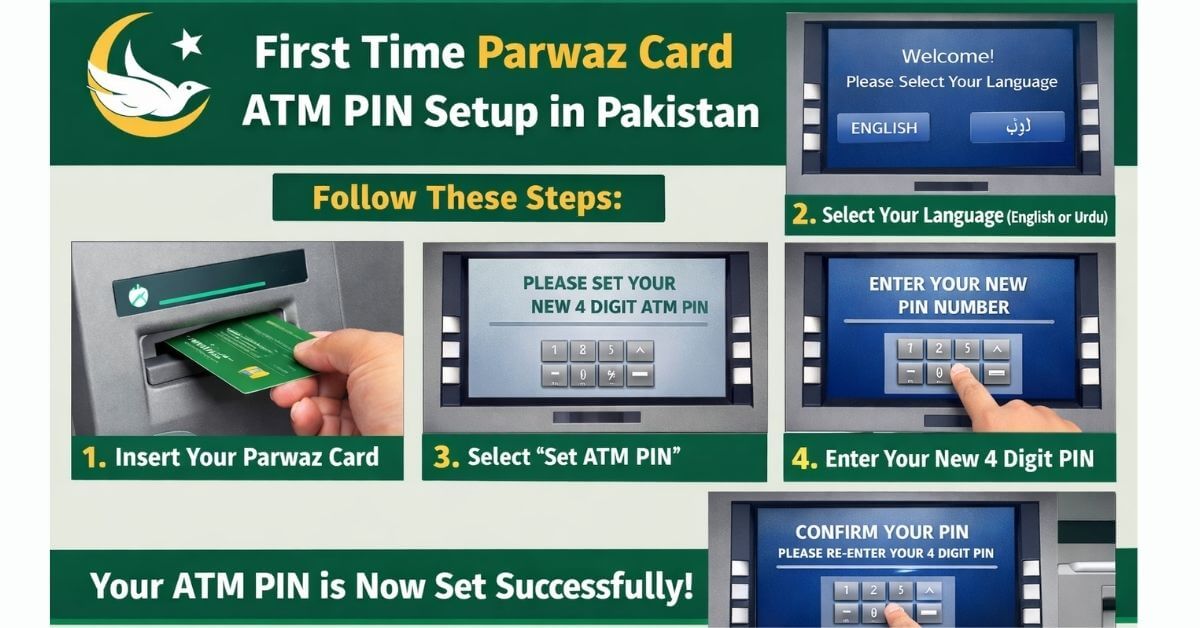

Check Also: First Time Parwaz Card ATM PIN Setup in Pakistan

Who should apply for Parwaz Card in 2026?

Parwaz Card is best for low-income families unemployed youth and informal workers who need small financial help for daily living skill development or micro income activities without business registration banking history or complicated paperwork.

Application Process Differences:

Parwaz Card Application Process

Parwaz Card applications are designed to be simple and accessible:

- Basic identity verification

- Income assessment

- Registration through official portals or offices

- Limited documentation

Approval timelines are generally shorter. https://parwaaz.psdf.org.pk/

Government Loan Application Process

Loan schemes involve multiple formal steps:

- Business proposal submission

- Financial assessment

- Bank interviews

- Background checks

- Risk evaluation

- Collateral verification

Approvals take longer, and many applications are rejected due to incomplete requirements. https://punjab.gov.pk/parwaaz-card

Approval and Verification Mechanism:

Parwaz Card Approval focuses on social and economic need, mainly verifying income status and eligibility.

Loan Scheme Approval prioritizes repayment capacity and business feasibility, assessing profitability, creditworthiness, and investment quality.

Usage Restrictions on Funds:

Parwaz Card Usage

Parwaz Card offers flexible usage for:

- Small earning activities

- Household needs

- Education or skill development

- Micro-enterprise support

There is less pressure compared to formal loans.

Government Loan Scheme Usage

Loan funds must be used strictly for approved purposes. Misuse can result in:

- Loan cancellation

- Penalties

- Legal action

- Blacklisting from future programs

Funds are monitored closely.

What makes Parwaz Card different from government loans?

Parwaz Card focuses on livelihood support and income stability while government loan schemes target business growth and large investments. Parwaz Card offers easier eligibility faster approval flexible usage and lower repayment pressure compared to traditional bank based loan programs.

Repayment Terms Comparison

Parwaz Card Repayment

Repayment terms are generally softer, with manageable installments based on beneficiary capacity. Some flexibility or relief options may apply.

Government Loan Repayment

Loan schemes follow banking models with:

- Fixed installments

- Interest or profit rates

- Strict recovery systems

- Penalties for late payments

Defaulters may face legal recovery.

Target Population Differences:

Parwaz Card mainly supports:

- Daily wage workers

- Informal sector earners

- Unemployed individuals

- Low-income families

Government loan schemes mainly support:

- Entrepreneurs

- Farmers

- Business owners

- Registered enterprises

- Skilled investors

Understanding this distinction helps avoid unnecessary rejections.

Which option is better for beginners in 2026?

Parwaz Card is better for beginners because it requires no business plan or collateral and offers smaller flexible support. Government loan schemes suit experienced entrepreneurs who can manage repayments paperwork and long term financial commitments.

Accessibility in Rural and Urban Areas:

The goal of Parwaz Card is to reach people in both rural and urban areas.

Loan programs tend to favor cities because banks, paper services, and business registration systems are all located in cities, making it harder for people in rural areas to get loans.

Risk Level for Applicants:

Parwaz Card Risk Level: Lower financial risk due to smaller amounts and flexible repayment.

Loan Scheme Risk Level: Higher risk because of larger loans, profit rates, business uncertainty, and repayment pressure.

Why Do Many Citizens Prefer the Parwaz Card in 2026?

Parwaz Card is gaining popularity because of:

- Easier eligibility

- Faster approval

- Lower financial pressure

- No complex business requirements

- Support for informal workers

- Minimal documentation

It is ideal for people seeking financial stability rather than expansion.

Why Government Loan Schemes Still Matter:

Despite Parwaz Card’s appeal, loan schemes remain essential as they:

- Promote entrepreneurship

- Create jobs

- Support industrial growth

- Improve agriculture productivity

- Encourage long-term investment

They play a critical role in national economic development.

Which Option Should You Choose?

Your choice depends on your goals.

Choose Parwaz Card if:

- You need small financial support

- You lack formal business registration

- You want income stabilization

- You face short-term financial pressure

Choose government loan schemes if:

- You have a solid business plan

- You want to expand operations

- You can manage repayments

- You need larger financing

Conclusion:

The Parwaz Card and government loan programs are both important in 2026, but they are not the same. Parwaz Card works on supporting people’s livelihoods and bringing them into the financial system, so that anyone can get help. Government loan programs are meant to help businesses grow and the economy grow, which means that people need to be better prepared financially.

Carefully think about your wants and abilities before you apply. Picking the right program can help you and your family become more financially stable, make more money, and access better chances.

Knowing these differences helps people in Pakistan make better financial choices and get the most out of the government’s aid programs.