Parwaaz Card Loan Amount in Punjab 2026 The Parwaaz Card scheme is becoming one of the most important ways for Punjab to get money in 2026. A lot of people want to start their own businesses or work abroad to make more money, but they can’t because they don’t have enough money. To deal with this problem, the Punjab government created the Parwaaz Card plan, which lets qualified people get loans without paying interest.

People often ask, “How much of a loan can I get with the Parwaaz Card?”

In simple terms, this full guide explains loan amounts, types, who can get them, how to pay them back, and the steps needed to apply, so everyone can understand how the program works.

What Is the Parwaaz Card Program?

The Parwaaz Card is a program from the Punjab government that is meant to help people get ahead financially. The program is mostly for young people, skilled workers, and small business owners who want to build a safe future but don’t have enough money to do so.

There are two main ways that the plan works:

- Small businesses can get loans to help them start up or grow.

- Offering money to help with working abroad

- Its main goal is to make Punjab financially independent, create jobs, and lower unemployment.

Loan limits and terms are different for each group because business needs and the cost of working abroad are different.

Main Purpose of the Parwaaz Card Scheme:

When the program began, it was to:

- Help young people without jobs start their own businesses.

- Aid skilled workers in finding better jobs abroad

- Depend less on short-term loans with high interest rates

- Help small and medium-sized businesses in Punjab grow.

- Boost family income by starting your own business or working abroad

Parwaaz Card eases people’s financial stress by letting them borrow money without interest. This makes people more likely to spend in their future.

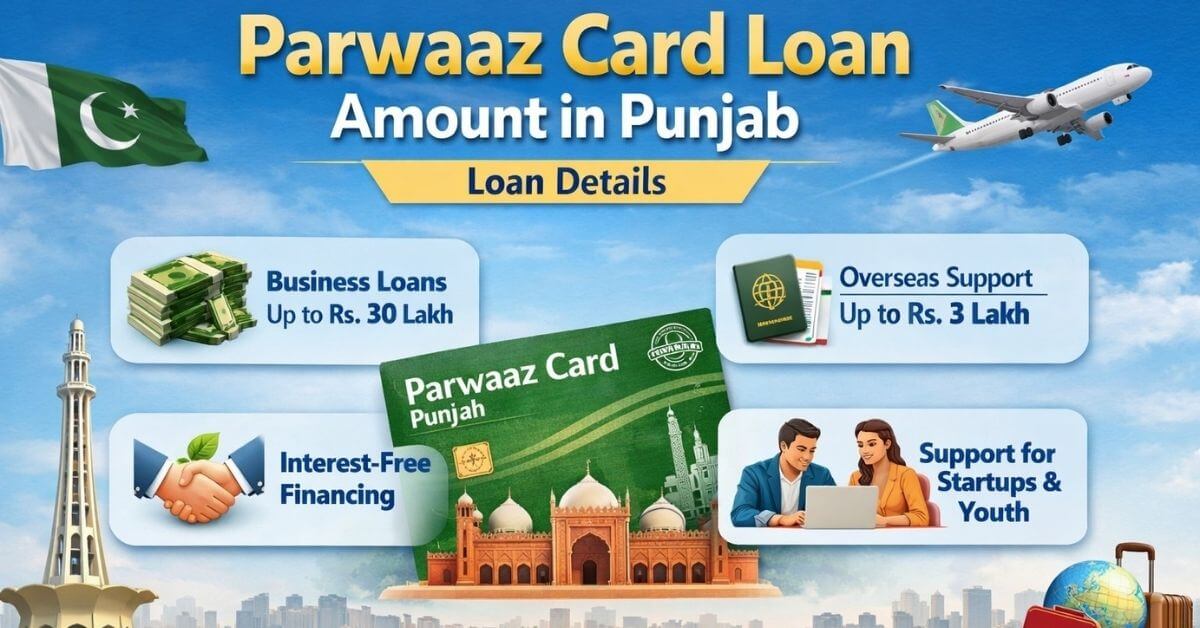

Loan Amount Available Under Parwaaz Card in 2026:

Loan amounts depend on the type of support required. Below is a detailed breakdown.

Business Loan Category:

Applicants who want to start or expand a business can receive financial support under the business category.

Typical limits include:

- Small businesses and startups may receive Rs. 3 lakh to Rs. 5 lakh with minimal collateral

- Medium-scale expansion projects may qualify for higher funding after evaluation

- Strong business proposals can receive up to Rs. 30 lakh

The final loan amount depends on:

- Nature of the business

- Strength of the business plan

- Applicant’s financial background

- Repayment capacity

- Required investment size

All business loans are interest-free, meaning borrowers repay only the principal amount.

Overseas Employment Loan Category:

Many skilled workers receive overseas job offers but struggle with pre-departure expenses. Parwaaz Card also provides financial assistance for this purpose.

These loans usually cover:

- Visa processing fees

- Medical examinations

- Air tickets

- Documentation costs

- Employment processing charges

Financial support in this category generally ranges between Rs. 2.5 lakh and Rs. 3 lakh, depending on the destination and verified expenses.

Funds are often released in stages to ensure proper utilization.

Is Parwaaz Card loan completely interest free?

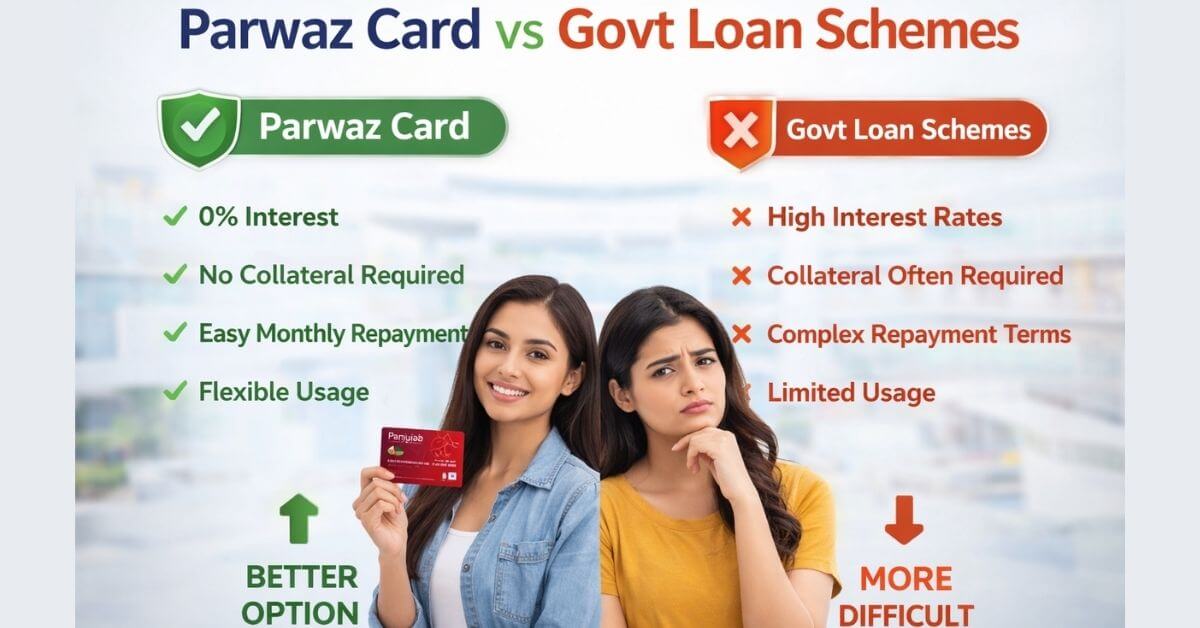

Yes, Parwaaz Card loans are fully interest-free. Borrowers repay only the original amount without markup. This reduces financial pressure and helps entrepreneurs and workers manage repayments easily while building income sources through business growth or overseas employment opportunities.

Why Interest-Free Loans Matter

The fact that there is no interest on the Parwaaz Card is one of its best features.

Below the Parwaaz Card:

- It does not charge any fees or interest.

- Borrowers only pay back the amount they borrowed.

- Flexible payment plans are available.

- There is still low financial stress.

This makes the program very appealing to young business owners and people who are just starting out in the job market.

Check Also: Parwaz Card Compared to Govt Loan Schemes

What documents are needed for a Parwaaz Card application?

Applicants must submit CNIC, proof of Punjab residence, bank details, and a business plan or job offer letter. Overseas applicants also provide passport copies. Additional educational or skill certificates may be required depending on lo

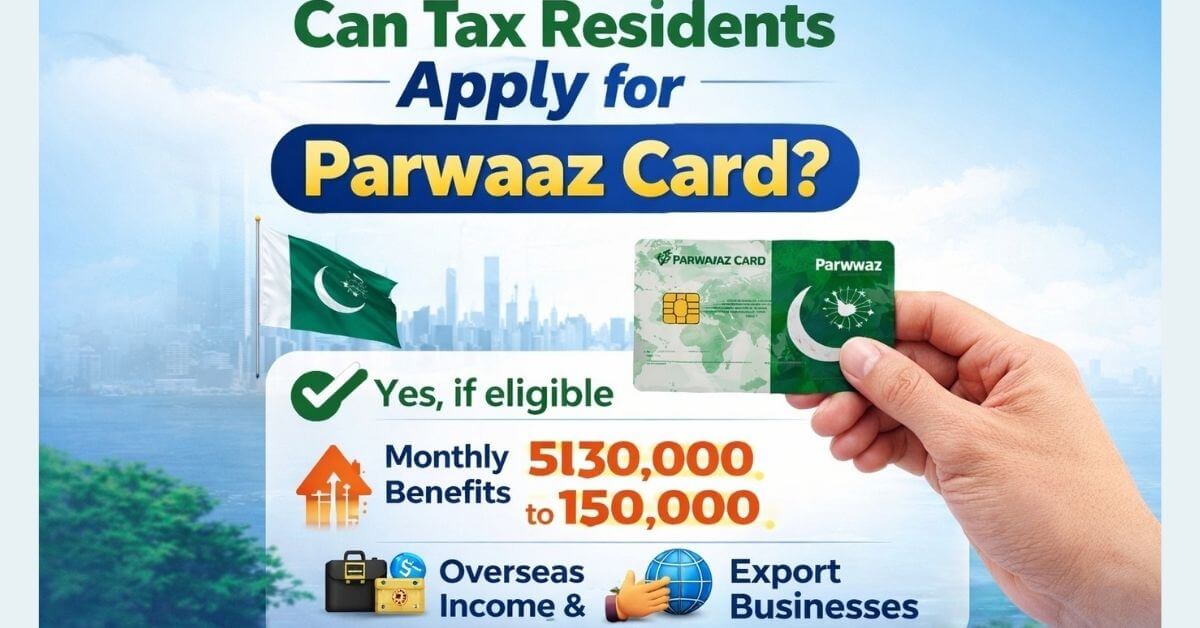

Who Can Apply for Parwaaz Card Loans?

Eligibility varies slightly by category, but general requirements include:

Basic Requirements

- The applicant must live in Punjab.

- Must have a valid CNIC

- Most of the time, 18 is the minimum age.

- No past of serious loan defaults

For Business Loan Applicants

- You need a clear business idea or plan for growth.

- Startups, small businesses, and shop owners who already have a business can apply.

- Entrepreneurs under 30 and women may get extra help.

For Overseas Employment Applicants

- A confirmed overseas job offer is required

- Employment documents must be verified

- Loan funds must be used only for job-related expenses

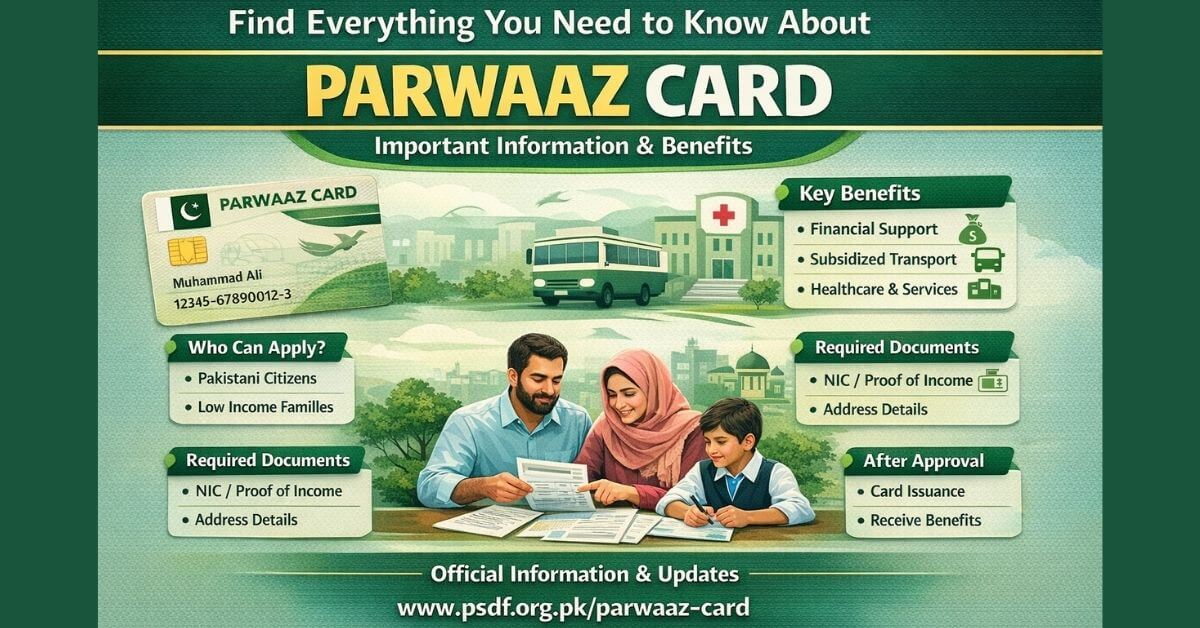

Required Documents:

These are the things that applicants should get ready:

- Copy of CNIC

- Proof that you live in Punjab

- Copy of passport (for applicants from outside of the United States)

- Letter of offer for a job (if needed)

- Plan or idea for a business

- Details of the bank account

- Certificates of education or skills

Depending on the type of application, you may be asked to send more papers.

How repayment works for Parwaaz Card loans?

Repayment usually starts after income begins from business or overseas employment. Installments are spread over time with flexible monthly or quarterly options. Authorities may adjust plans based on earning capacity, helping borrowers repay comfortably while maintaining financial stability.

Loan Repayment Method:

Repayment is designed to remain manageable.

Business Loans

- Repayment usually begins once the business generates income

- Installments are spread over several years

- Monthly or quarterly options may be available

- Flexible plans reduce pressure on startups

Overseas Employment Loans

- Repayment typically starts after the applicant begins earning abroad

- Installments are adjusted according to income

- Early repayment may be allowed

Regular repayment helps maintain a positive financial record.

Benefits of Parwaaz Card Program:

- Interest-Free Financial Help: The Parwaaz Card offers loans with no interest, so applicants only have to pay back the principal amount. This means that applicants don’t have to pay high bank fees, which makes it easier for families, young people, and entrepreneurs to handle their money and invest with confidence in business or overseas work.

- High Loan Limits for Business Growth: Applicants who are eligible can get up to 30 lakh for accepted business projects. This helps startups and small businesses across Punjab grow, buy equipment, and create new jobs.

- Dedicated Help for Overseas Employment: Skilled workers with confirmed job offers in other countries can get help paying for visa fees, medical tests, plane tickets, and paperwork. This takes away big costs up front and makes the move to working abroad easier.

- Flexible and Affordable Repayment Plans: Payment plans are based on when you start making money, with installments spread out over time and starting when you start making money. This helps you stay stable in the long run and reduces financial stress.

- Economic Empowerment for Youth and Entrepreneurs: This program helps young people and small business owners become financially independent by giving them access to cash. This also helps the local economy in Punjab.

- Transparent Government-Backed Program: The Punjab government runs the Parwaaz Card program, which makes sure that applications are processed safely, that applicants are checked for suitability fairly, and that funds are used correctly. This gives applicants peace of mind that their loans are being handled through official and trustworthy channels.

Common Reasons Applications Are Rejected:

Applications may be turned down because:

- Information that is wrong

- Unfinished papers

- Poor business plans

- Unchecked job openings abroad

- Not good with money

Careful planning greatly increases the chances of approval.

Tips to Increase Approval Chances:

- Make an easy-to-understand business plan.

- Send in documents that are correct and full.

- Only use the legal ways to apply.

- Make sure you can pay back the loan.

- Keep contact information up to date.

How to Apply for Parwaaz Card Loan?

This is how the process usually works:

- Sign up at the official Parwaaz Card website or at one of the sites listed. https://parwaaz.psdf.org.pk/

- Carefully fill out the application form.

- Send or upload the necessary papers

- Applications are checked out.

- The decision to approve is sent.

- The money is given after the last checks.

Applicants should check on their applications often to see how they are going.

Expected Impact in 2026:

In 2026, Parwaaz Card is expected to support thousands of families across Punjab by:

- Creating new small businesses

- Enabling overseas employment

- Increasing remittance inflows

- Strengthening household finances

Conclusion:

In 2026, the Parwaaz Card program gives people who don’t have much money but want to make their future better a great chance. Those applying for business jobs can get up to Rs. 30 lakh, and those looking for work abroad can get around Rs. 3 lakh to cover the costs of travel and paperwork.

With interest-free loans and open payment plans, the scheme makes it easier for people to get the money they need. People who apply with the right paperwork and correct information have a better chance of being accepted.

This program called Parwaaz Card can help people who want to start their own business or work abroad by giving them extra money.