The CM Punjab Announces Parwaaz Card Zero Markup Loans for 2026. This is a big step toward financial inclusion and economic empowerment for citizens who deserve it. People from all over Punjab can use this online tool to apply for Parwaaz Card loans with no interest rates. They don’t have to go to an office or fill out a lot of paperwork.

The Punjab government wants to help young people, women, small business owners, and low-income families who want to start or grow their own businesses. This program is part of that plan. The Parwaaz Card is useful for people who are having trouble with high-interest loans and restricted access to traditional banking because it has digital applications and clear processing.

What Is a Parwaaz Card?

The Parwaaz Card is a financial aid program backed by the Punjab government that gives interest-free loans to people who qualify. These are its main goals:

- Help people become self-employed

- Help out small businesses

- Families who can’t afford private bank loans should not have to worry about their money as much.

People who are chosen get loans with no interest added for starting a business, growing it, buying tools and equipment, or doing other legal business activities. Instead of giving short-term cash aid, the scheme works on giving people long-term power.

What businesses qualify for Parwaaz Card loans?

Micro and small businesses, including shops, services, home-based work, and vocational projects, qualify for zero markup loans under Parwaaz Card 2026. Applicants must clearly explain their business plan and intended use of funds for approval.

Key Features of Parwaaz Card Program:

- Zero-Margin Loans: People who get these loans only have to pay back the initial amount over time.

- Digital Application Process: You can apply online from anywhere in Punjab, which saves you time and money on the journey.

- Help for Small Businesses: This section is all about micro and small business plans, work-from-home jobs, and vocational activities.

- Transparent Screening: Structured verification makes sure that approvals are fair and based on quality.

Who Is Eligible for a Parwaaz Card?

Usually, the following are required to be eligible:

- Residence: You must live in Punjab and have a current CNIC.

- Background on income: people with low to moderate incomes who can’t get standard bank loans

- Business Intent: A clear plan to start or grow a small business or action that makes money.

- Age requirements: Usually teens and adults who are working.

Benefits of CM Punjab Announces Parwaaz Card Zero Markup Loans 2026:

- Financial Empowerment for Citizens: The Parwaaz Card gives eligible people zero-markup loans, so they can start or grow small businesses without having to worry about high interest rates. This helps them become financially independent in the long run.

- Help for Small Business Owners: The program supports micro- and small-scale business growth by giving interest-free loans. This lets entrepreneurs, young people, and women grow their businesses and help Punjab’s economy.

- Digital and Clear Application Process: The brand-new online portal makes it easy for applicants to fill out forms, upload documents, and check on the state of their application. This cuts down on red tape and makes loan approvals more clear.

- Job Creation and Economic Growth: The plan boosts the local economy by giving money to businesses that make jobs, help communities, and make Punjab’s economy more productive overall.

- Inclusive Access to Credit: The program helps people with low and middle incomes who might not be able to get loans from traditional banks. This fills in the gaps in financial services and makes people less reliant on private lenders.

- Structured and Affordably Priced Repayment Plans: Loans are paid back in manageable installments with no interest, which makes it easier for borrowers to stay on track while investing wisely in their business or activities that make money.

Check Also: What Happens If You Miss Parwaaz Loan Payments

Can women apply for Parwaaz Card 2026 loans?

Yes, the scheme encourages female entrepreneurs in Punjab to apply. Women can receive interest-free loans to start or expand small businesses, supporting financial independence and promoting gender-inclusive economic growth.

How to Apply for CM Punjab Announces Parwaaz Card Zero Markup Loans 2026?

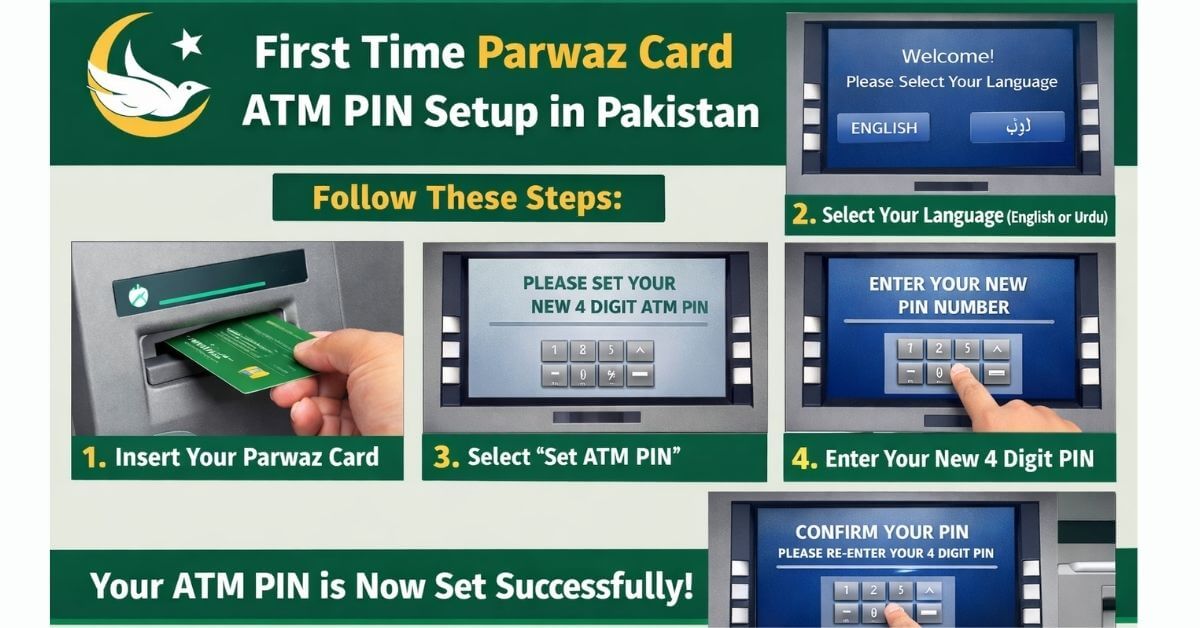

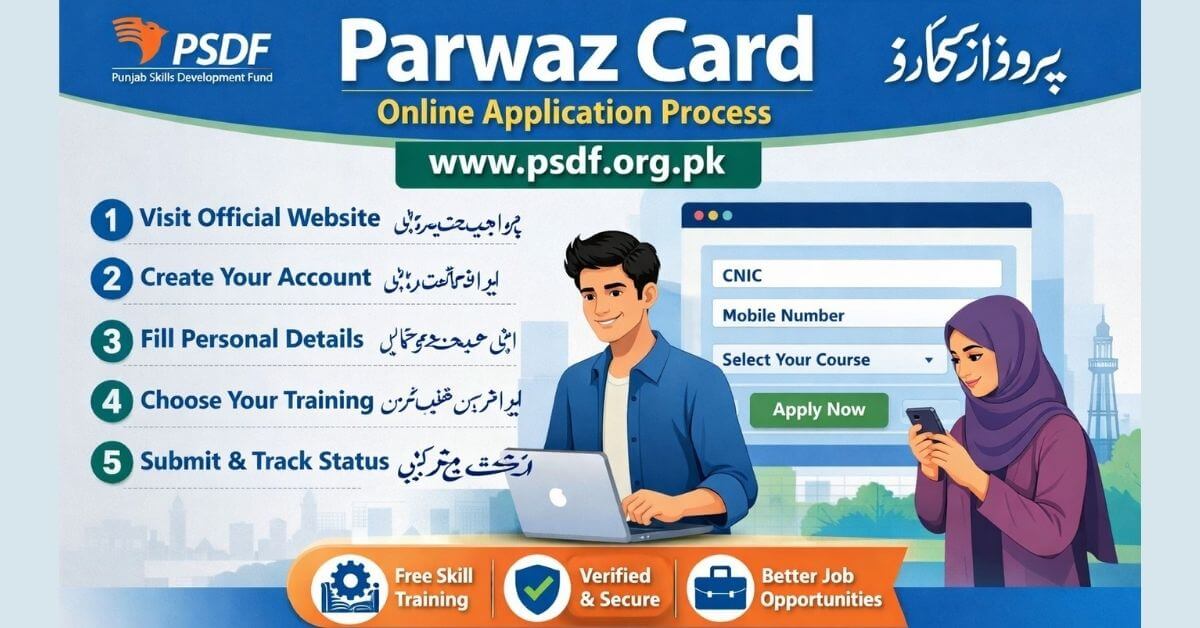

Step 1: Visit the Official Parwaaz Card Portal

Use the site that the Punjab government set up. Use only the official page to stay away from scams. https://punjab.gov.pk/parwaaz-card

Step 2: Create an Account

Fill out the form with your CNIC, phone number, and other personal information. Keep your phone on for proof.

Step 3: Fill the Application Form

Give correct information about yourself, your finances, and your business. Giving wrong information could lead to being turned down.

Step 4: Upload Required Documents

Include photos, copies of your CNIC, and papers that back up your business or skills.

Step 5: Submit Application

Submit the form online and receive a confirmation or tracking number. https://parwaaz.psdf.org.pk/

Step 6: Verification and Review

Government departments verify details and assess eligibility. Some applicants may be contacted for additional information.

Step 7: Approval and Loan Disbursement

Approved applicants are notified via the portal or SMS. Loans are disbursed through designated banking channels.

Repayment and Loan Use:

- Installments: Pay back only the initial amount over a period of months.

- Only for Authorized Uses: Misusing it could result in fines or being banned in the future

Why Does the Parwaaz Card Matter for Punjab?

The Parwaaz Card fills a gap in Pakistan’s banking system where many people can’t get low-cost loans. The Punjab government encourages people to start their own businesses and lessens people’s dependence on informal lenders by giving out loans with no interest.

This project also encourages the creation of jobs in the neighborhood, which helps the local economy grow.

Common Mistakes to Avoid:

- Incorrect Information: Always give correct information

- Using Unofficial Sources: Stay away from third-party websites and agencies.

- Weak Business Case: Make it clear how the loan will be used.

Is Parwaaz Card funding available nationwide?

The program is currently exclusive to Punjab residents. Applicants must provide a valid CNIC and proof of Punjab residency to access zero markup loans and benefit from the government’s financial support initiative.

Conclusion:

The CM of Punjab, Maryam Nawaz, opened the Parwaaz Card applicants site, which lets people apply for cards online and offers loans with no interest. Citizens who are eligible should apply through the official portal, carefully follow the directions, and be smart about how they spend their money. If the Parwaaz Card is used correctly, it could help small businesses in Punjab grow over the long run.