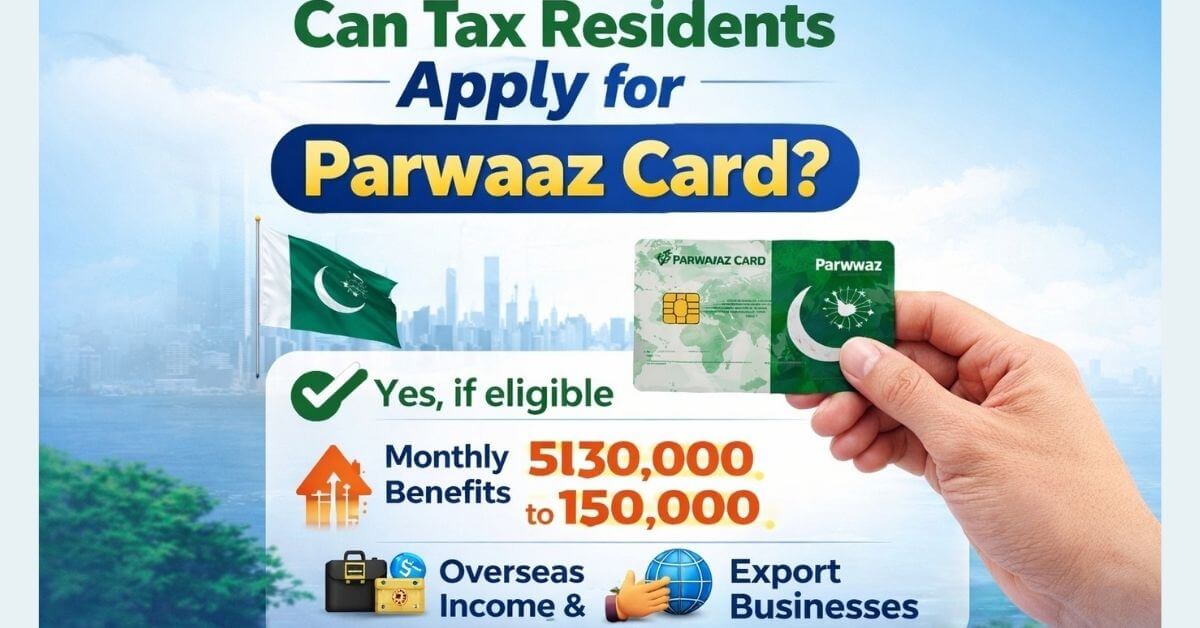

Can Tax Residents Apply for Parwaaz Card 2026? A lot of people who want to apply for theParwaaz Card Program are still not sure who is eligible, especially when it comes to resident vs. nonresident Pakistanis.

In this in-depth help, we make it clear:

- The Parwaaz Card Program is made for these people:

- Whether people who pay taxes can apply

- How to tell the difference between resident and non-resident citizenship

- Income and where you live are important factors

- Who has a better chance of being liked?

- Misconceptions people often have

- Useful tips before you apply

The goal is simple: to clear up any misunderstanding so that applicants don’t waste time sending in applications that are wrong or missing information.

Understanding the Purpose of the Parwaaz Card Program:

Before we talk about who can get a Parwaaz Card, it’s important to know why the program exists.

The program was created to help people with their finances and jobs, especially those who were traveling or working abroad or taking part in the economy across borders.

Some of its main goals are

- Helping Pakistanis living abroad

- Getting people to send money back home

- Helping workers and professionals who are looking for work abroad

- Providing financial help to people who are qualified

A lot of people think the school is only for people who are not living in Pakistan because it has an international focus. The truth is that qualifying is more complicated.

Who has higher approval chances for Parwaaz Card?

Applicants with overseas employment, foreign client income, remittance history, or export-linked businesses generally receive higher approval priority. Freelancers earning internationally and returnees from foreign jobs also qualify more easily, provided they submit accurate documents and meet financial requirements.

Who Is Considered a Non-Resident Pakistani?

Most of the time, a non-resident Pakistani is someone who:

- stays or works abroad for long amounts of time

- Has a work or living permit from another country

- Brings in money outside of Pakistan

- Most of the year is spent abroad

They still have Pakistani citizenship, but they don’t live in Pakistan full-time. In most cases, they:

- Send money back home

- Keep your Pakistani bank accounts open.

- Visit once in a while

- Help the people in Pakistan.

Since the Parwaaz Card Program encourages people to work in international businesses, Pakistanis living abroad are usually the main focus.

Who Is a Tax Resident in Pakistan?

A person is a tax resident if they:

- Spends most of the year in Pakistan

- Brings in money in the area

- Putting in taxes in Pakistan

- Is linked to Pakistan’s tax system

In simple words, you are a tax resident if you live and work in Pakistan and contribute to the economy of the country.

A lot of people think that taxpayers can’t get a Parwaaz card. Not all of this is true.

Can Tax Residents Apply for Parwaaz Card 2026?

Yes, but there are some rules.

Tax residents don’t instantly get kicked out. But approval depends on how well the application fits in with the program’s main goals.

Usually, authorities look at

- How to make money

- Work or business activities

- Connections or earning prospects abroad

- How much money you have

- Fit with the goals of the program

A tax resident who meets these requirements can apply. But applicants who don’t have any foreign or qualifying economic ties may have a harder time getting approved.

Why There Is Confusion About Eligibility:

Several factors contribute to widespread misunderstanding:

Early announcements emphasized overseas Pakistanis:

Initial messaging highlighted overseas communities, leading many to believe residents were excluded.

Social media misinformation:

Unofficial videos and posts often share incomplete or inaccurate details.

Limited public guidelines:

Many applicants rely on hearsay instead of official eligibility criteria.

Similar past schemes:

Previous programs targeted only non-residents, creating assumptions about this one.

Check Also: Find Everything You Need to Know About Parwaaz Card

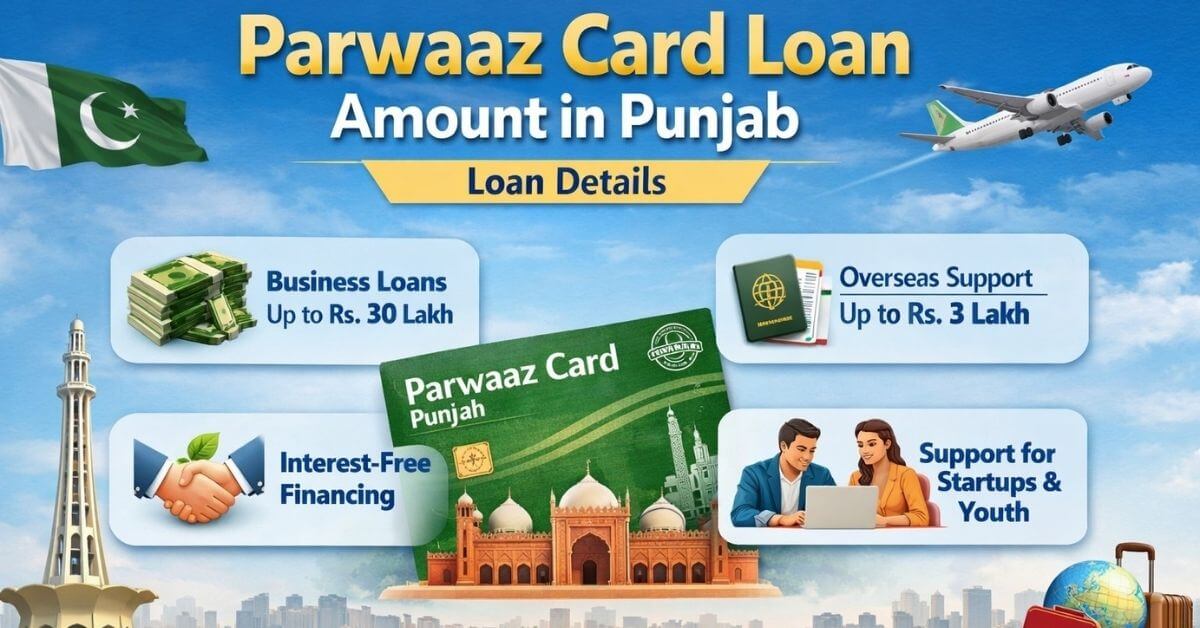

Situations Where Tax Residents May Qualify:

Tax residents in Pakistan may qualify under specific circumstances, including:

Individuals working with foreign clients

Freelancers or remote professionals earning in foreign currency contribute to Pakistan’s foreign exchange.

Applicants planning overseas employment

Those preparing for foreign jobs or migration may qualify with proper documentation.

Returnees with overseas work history

Recent returnees from abroad may still fall within eligible categories.

Business owners linked to foreign markets

Entrepreneurs involved in exports or overseas trade may also qualify.

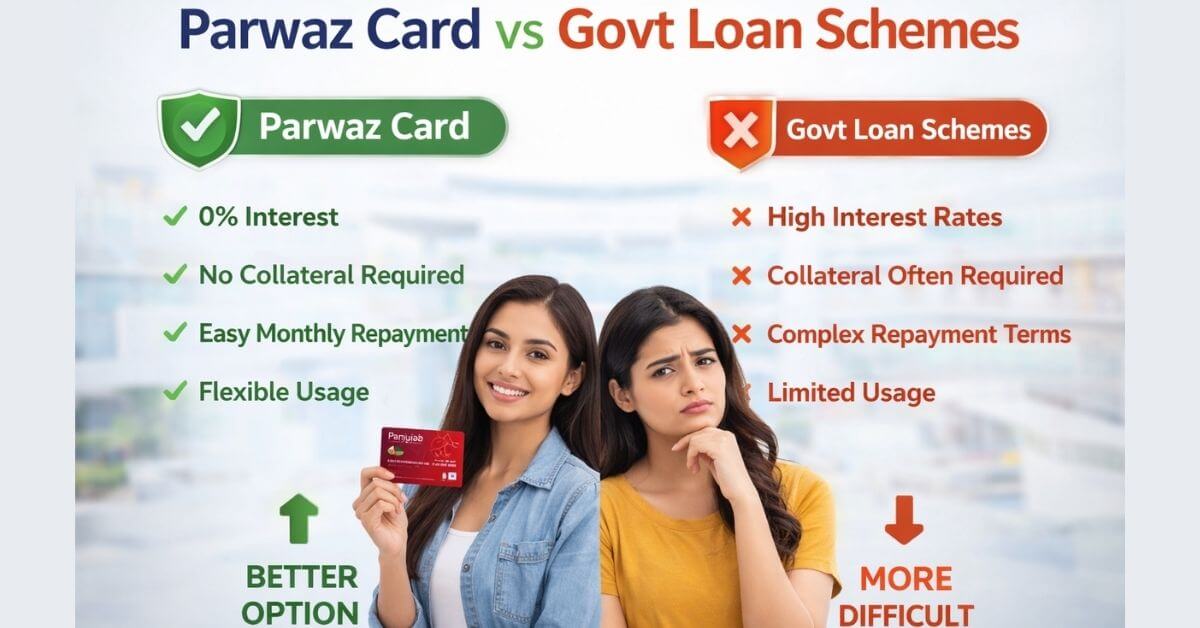

Does tax filing alone guarantee Parwaaz Card approval?

No, being a tax filer does not guarantee approval. Authorities also review income type, employment situation, overseas connections, and documentation. Applicants must align with program goals focused on international earning or mobility to improve their chances of successful Parwaaz Card approval.

Cases Where Approval Becomes Difficult:

Usually, applications are turned down because:

- No connection to foreign cash or work abroad

- Documentation that is missing or wrong

- Incorrect information on the application

- Not meeting the financial requirements

- Not understanding the rules for eligibility

Just because you file your taxes doesn’t mean you’ll get approved.

Key Factors Authorities Consider:

Most applications are evaluated based on:

Economic linkages:

Does the applicant contribute to or connect with international economic activity?

Employment status:

Is the applicant employed, self-employed, or preparing for overseas work?

Financial standing:

Does the applicant meet the scheme’s financial requirements?

Documentation accuracy:

Errors or false information often lead to rejection.

Common Myths About the Parwaaz Card Program:

Myth: Only overseas Pakistanis can apply

Reality: Some residents can qualify if they meet eligibility conditions.

Myth: Tax filers are automatically eligible

Reality: Tax filing alone does not ensure approval.

Myth: Everyone who applies gets approved

Reality: All applications undergo verification.

Myth: Residency is the only requirement

Reality: Economic and employment factors matter significantly.

This is the official website for the Ministry of Overseas Pakistanis and Human Resource Development. https://ophrd.gov.pk/

Who Has Higher Approval Chances?

From what we know so far, people who are more likely to be approved are:

- Workers abroad who send money back home

- People who are getting ready to work abroad

- Freelancers who work for companies in other countries

- People who came back from jobs abroad

- People who run businesses that deal with overseas markets

Applicants who don’t have business ties to other countries usually have a smaller chance of being accepted.

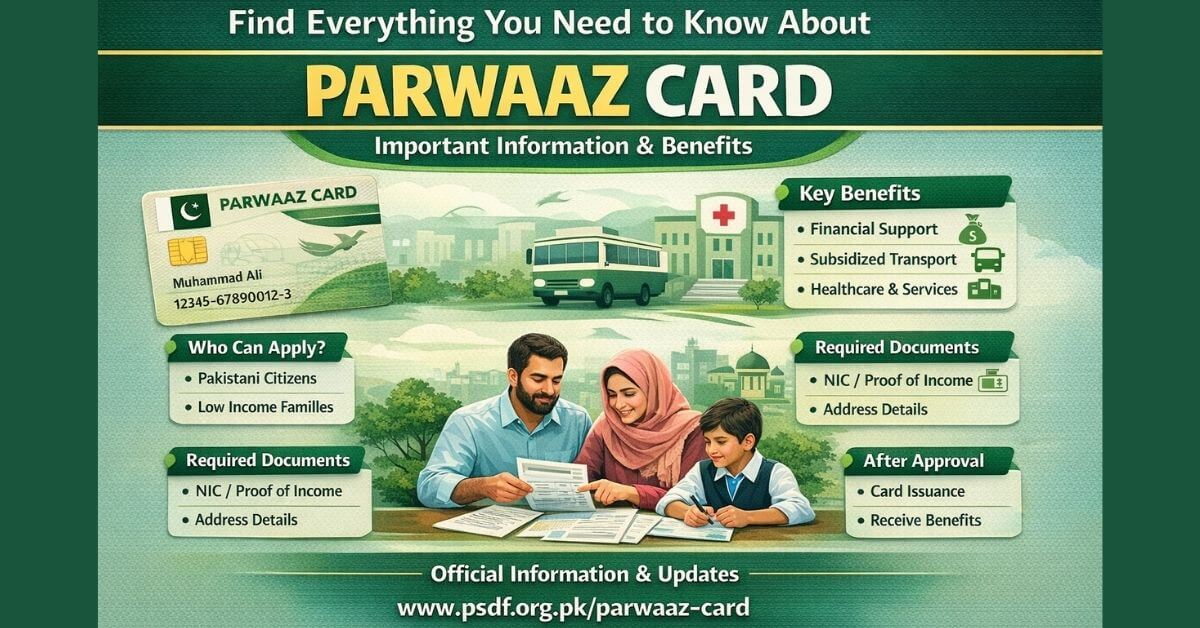

Advice for Tax Residents Planning to Apply?

If you live in the country and are thinking about applying,

- Carefully look over the standards for eligibility

- Put together tax papers and proof of income

- Draw attention to any foreign income or ties to other countries

- Don’t give out wrong information.

- Only use the legal ways to apply.

- Do not use agents or services that are not legal.

Correct paperwork greatly raises the chances of approval.

Possible Future Policy Changes:

Government policies change all the time. The government may:

- Increase who can apply

- Change the criteria

- Create new types of applicants

- Streamline the conditions

Tax residents who don’t qualify now might be able to in the future, so it’s important to keep up with government updates.

Impact of Including Tax Residents:

Allowing eligible tax residents benefits:

- Freelancers bringing in foreign income

- Export-oriented businesses

- Skilled professionals seeking global opportunities

- Returning overseas workers

This approach also strengthens domestic economic participation.

Final Verdict: Residents vs Non-Residents

To summarize:

- The Parwaaz Card Program mainly supports individuals connected with overseas income or employment

- Non-resident Pakistanis are primary beneficiaries

- Tax residents are not fully excluded

- Eligibility depends on economic and employment factors

- Documentation and qualification matter more than residency alone

The program is not strictly limited to non-residents, but residents must align with program objectives to qualify.

Conclusion:

The biggest mistake applicants make is depending on rumors instead of the official rules for eligibility. The Parwaaz Card Program is meant to help people who want to move up in their careers or make money abroad, not just sort applicants into groups based on where they live.

Tax residents who have foreign income or work connections may still be able to apply, but those who don’t may have a harder time getting approved.

Before you apply, make sure you carefully read the requirements, gather the right paperwork, and stay away from false information. This cuts down on time and improves the chances of acceptance.

As rules change, more people may be able to participate in later stages. For now, applications that are based on facts always work better than ones that are based on theories.