When Does Parwaaz Card Loan Repayment Start? One of Punjab’s most important government-backed financial programs is the Parwaaz Card Loan Scheme, which helps young people, workers, and small business owners get access to loans. Most of the time, eligibility and approval get the most attention. However, many candidates still don’t know when they have to start paying back the loan.

It is very important to know when the refund is due. It helps people plan their money wisely so they don’t get fined and can keep getting help from the government in the future. This guide explains how to pay back a Parwaaz Card loan, including the grace time, when payments start, how payments are structured, penalties, and what the borrower is responsible for.

Overview of Parwaaz Card Loan Scheme:

The Parwaaz Card Loan is a structured financing scheme that the Punjab government set up to encourage people to start their own businesses and work for themselves. Instead of unlimited cash, money is given out through a special card system that makes sure it is used correctly and effectively.

This loan can only be used for business, skill development, and things that make money. It’s not a grant, and the legal terms and conditions say that you have to pay it back in full.

Does Parwaaz Card Loan Repayment Start Immediately?

No, you don’t have to start paying back the cash right away.

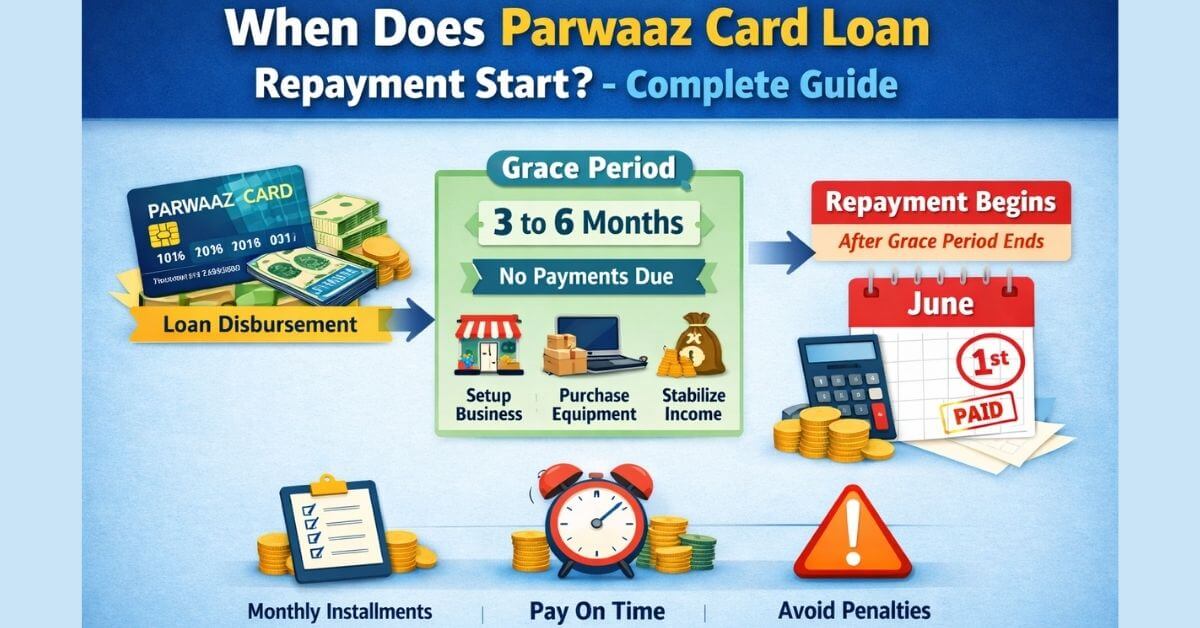

The Parwaaz Card Loan has a grace period where the borrower doesn’t have to pay any installments. After the grace time is over, the loan is officially due.

What Is the Grace Period in the Parwaaz Card Loan?

Purpose of the Grace Period:

During the waiting period, borrowers have time to:

- start a business or grow one

- Buy goods, tools, or equipment

- Keep cash flow stable.

- Start making money before you start making bills.

This arrangement lowers early financial stress and makes it easier for loans to be paid back.

Duration of the Grace Period:

In most cases, the grace period ranges between

- Minimum: 3 months

- Maximum: 6 months

The exact duration depends on the loan category, approved amount, and terms mentioned in the loan agreement. Borrowers are informed through official documents and SMS notifications.

When Exactly Does Repayment Begin?

At the end of the vacation period:

- Payments must be made every month.

- The due date for the first payment is set.

- Payments must begin right away.

The loan deal makes it clear when the full amount is due.

Example Repayment Timeline:

- Loan disbursed: February

- Grace period: 3 months

- No installments: March, April, May

- Repayment begins: June

From June onward, borrowers must pay monthly installments on time.

What happens if a borrower misses Parwaaz Card installment?

Missing a monthly installment can result in late fees, temporary suspension of the Parwaaz Card, negative repayment history, and disqualification from future government schemes. Timely payments are essential to maintain eligibility and avoid legal or financial consequences.

How Are Parwaaz Card Loan Installments Structured?

Monthly Installments:

The loan is paid back in equal monthly payments that are based on:

- Loan amount in total

- Length of repayment

- What kind of markup or service charges apply

Installments are made so that small businesses and workers can still afford them.

Repayment Duration:

Typically, repayment periods range from

- 24 months (2 years)

- Up to 60 months (5 years)

Longer repayment periods result in lower monthly installments.

Is the Parwaaz Card Loan Interest-Free?

The Parwaaz Card Loan is available with better rates from the government.

- Some types of loans don’t charge interest.

- Some have very low markups.

The legal loan agreement includes full financial information. This method is much less expensive than conventional bank loans.

How Do Borrowers Repay the Loan?

Approved Repayment Methods

Most of the time, repayments are made by:

- Automatic withdrawals from bank accounts that are linked

- Payments made through partner banks

- internet payment methods that are okay with the government

Those who owe money get SMS alerts before their payments are due.

What Happens If an Installment Is Missed?

Missing a payment can have serious consequences.

Possible Penalties

- Late payment charges

- Temporary suspension of the Parwaaz Card

- Negative repayment record

- Disqualification from future government schemes

- Legal recovery action in extreme cases

Even a single missed installment can affect future eligibility.

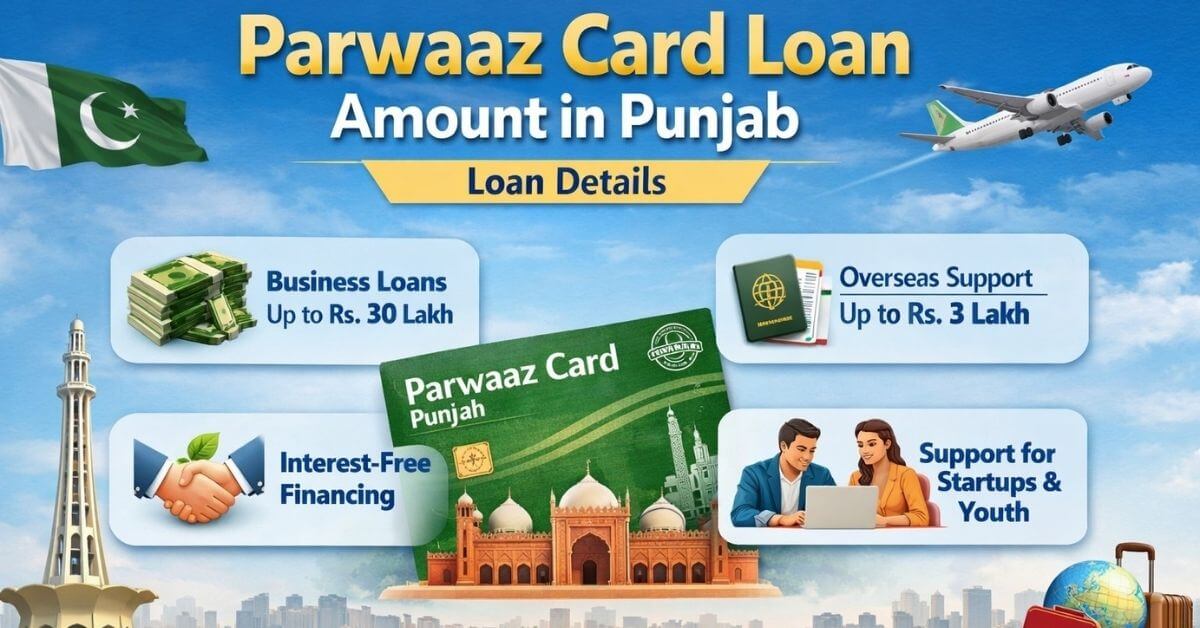

Check Also: Parwaaz Card Loan Amount in Punjab – Loan Details

How can borrowers check Parwaaz Card loan repayment schedule?

Borrowers can check repayment schedules through the official Parwaaz Card online portal, SMS alerts from partner banks, customer support helplines, or assigned bank branches. Regular monitoring ensures timely installment payments and prevents missed deadlines that could impact future eligibility.

Can the Repayment Schedule Be Changed?

Repayment Rescheduling:

Borrowers may ask for a new payback plan in very few real cases. If approval is given,

- Clear evidence of financial stress

- What the government did at the time

- Review by the right officials

Rescheduling isn’t always possible and needs to be accepted by an official source.

How to Check Parwaaz Card Loan Repayment Details:

Borrowers can keep track of information about payments through:

- The main website for the Parwaaz Card https://parwaaz.psdf.org.pk/

- Partner banks sending SMS alerts

- Helplines for customer service

- Given bank branches

Regular checks help make sure that payments aren’t missed.

Responsibilities of Parwaaz Card Loan Holders:

People who borrow money must:

- Don’t use the money for anything else.

- Stick to the plan for paying back the loan.

- Keep contact information up to date.

- Pay attention to government notices

If you don’t follow the rules, you could face fines or lose your cash.

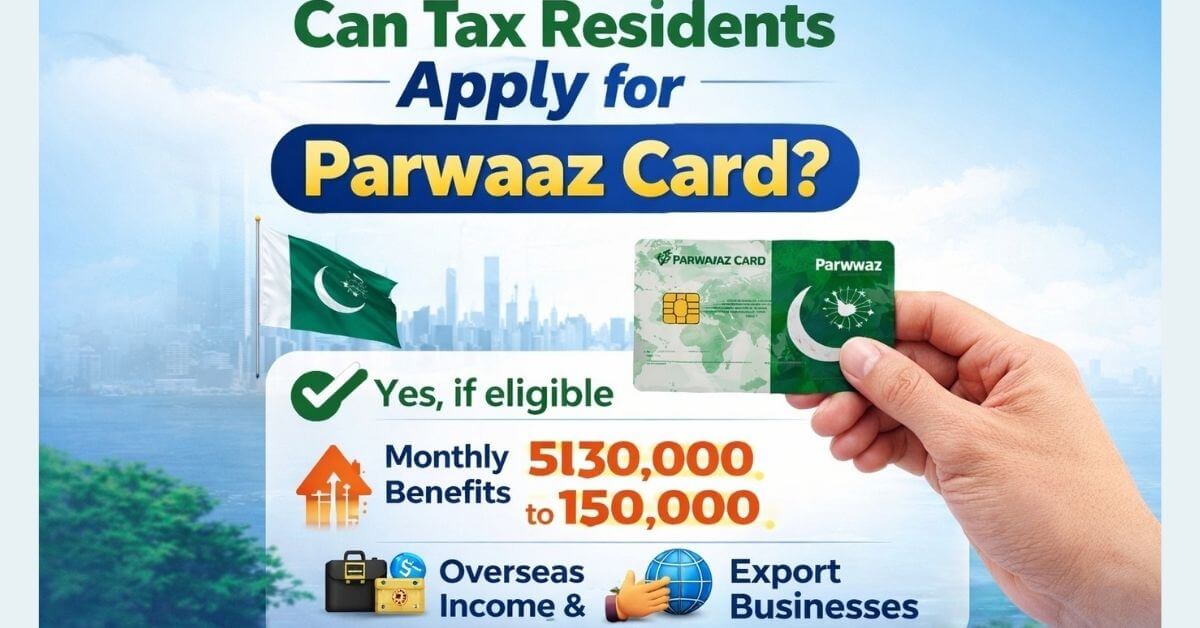

Is the Parwaaz Card loan interest free for everyone?

Some Parwaaz Card loan categories are completely interest-free, while others carry minimal markup. Exact financial terms are stated in the loan agreement, making the scheme far more affordable than commercial loans and accessible for youth, freelancers, and small business owners.

Why Timely Repayment Matters

Paying installments on time helps borrowers:

- Maintain a clean financial record

- Stay eligible for future government programs

- Build trust with lending institutions

- Avoid stress, penalties, and legal issues

Government loan databases are interconnected, making repayment history extremely important.

Common Misunderstandings About Parwaaz Card Repayment

“It’s free money.”

Not right. The loan has to be paid back in full.

“No payment for a grace period”

Not right. Paying back the loan starts after the grace period.

“One late payment doesn’t make a difference.”

Not right. There can be big problems with even one delay.

Practical Tips for Parwaaz Card Borrowers:

- Plan ahead and save your monthly money.

- Keep track of government texts and alerts

- Only use the money for work.

- Get help right away if you’re having money problems.

- Don’t ignore notices to pay back money.

Strong money management skills make sure that loans are paid back smoothly.

Are monthly installments mandatory after grace period ends?

Yes, once the grace period ends, monthly installments become mandatory. Borrowers must follow the repayment schedule strictly, ensuring timely payments to avoid penalties, maintain eligibility for future government programs, and build a positive financial record with lending authorities.

Conclusion:

After the grace period, which is usually 3 to 6 months after the loan is given out, the Parwaaz Card Loan must be paid back. After the grace period is over, borrowers must pay back the loan in monthly payments as agreed.

The Parwaaz Card Loan is a great chance, but you can only get the benefits if you use it wisely and pay it back on time. People who borrow money and follow the rules can still get help from the government in the future.

Paying back the Parwaaz Card Loan doesn’t start right away. There is a 3- to 6-month grace period before monthly payments start. Paying back loans on time is important to avoid fees and keep your eligibility for future plans.